Does it make sense to include Digital Assets in a traditional investment portfolio?

- Daniele Bernardi

- Jul 7, 2023

- 4 min read

Today, digital assets represent the most asymmetrical bet in the history of investments.

What does "asymmetrical" mean? It means that, if on the one hand the value of the investment could go to zero (like all financial instruments by the way), on the other hand the value of the investment could also increase tenfold (as has already happened several times in recent years).

Imagine investing three per cent of your assets in this Asset Class: assuming that the rest of the portfolio remains immobile, if this asset class were to go to zero you would have lost one per cent and therefore you would end up with an equivalent value of 97; if instead it multiplied its value tenfold, then you would find yourself with a portfolio valued at 130! this is the great asymmetry between potential loss and gain.

The question arises: if Bitcoin had a 50% chance of going to zero and a 50% chance of going to 500%, would you bet 3% of your assets?

Since we are talking about investments and not bets, we can safely say that the chances that Bitcoin will go to zero in the next 5 years are very low, probably less than 1%, while the chances that it will multiply its value by five, perhaps putting 6 -8 years, but the chances are at least 50%.

Furthermore, you are not obliged to bet only on Bitcoin, but nowadays there are the first investment funds that allow you to diversify between various Digital Assets and further reduce risks.

Having said that, it is obvious that the wrong question is: "why on earth should I invest in it?" but the right question is: "how much is the correct percentage to invest in proportion to my assets?".

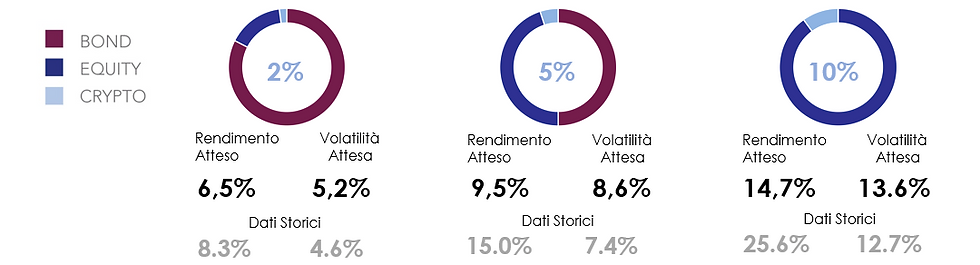

Figure 1: three classic portfolios with an increasing risk profile, showing expected return and volatility

Taking into consideration that the historical correlation between digital assets and other investment categories is very low, in fact, if I introduce a percentage of digital assets in the portfolio, the impact on the volatility of the portfolio will be minimal, if the volatility of the asset we introduce multiplied by its percentage will be equal to or less than the portfolio.

Let's take an example to make people understand: if I have a portfolio made up of bonds that have 3% volatility, if I introduce 10% of a security that has 30% volatility, if the correlation were 1 then the portfolio would increase volatility beyond 3%; if the correlation were zero the portfolio would have lower volatility, if it had correlation -1, the portfolio's volatility would go to zero (assuming it is always at -1, of course).

Figure 2: Expected return difference and volatility with inclusion of digital assets

We have now hypothesized what could be the right percentage of Digital Assets to include in the portfolio to keep the expected risk of the same at the same level; the next question to answer is the following: "what is the component of digital assets that does not impact the expected volatility but improves the expected return?"

Obviously, this percentage changes based on the customer's risk profile, in fact we have noticed that by inserting 10% of digital assets in the portfolio we have the best increase in the expected return while keeping the volatility of the portfolio practically unchanged.

If the results of the simulation seem too high, here are the historical returns from 2015 to the end of 2021 of these portfolios, which were even higher.

Figure 3: Comparison between expected and historical returns from 2015 to 2023

A dutiful clarification: these simulations were made by taking profit every time the digital assets doubled in value, leaving only the initially invested capital, this to keep volatility under control.

It is clear from this simulation that inserting digital assets, perhaps through a savings product managed with an ISIN code and all the security and protection that these financial instruments offer, is not only desirable, but even fundamental in a period of uncertainty such as the current one combined with high inflation eroding purchasing power over time.

Figure 4: Risk-reward ratio when you add 10% in Digital Assets in your portfolio

In this graph, however, which relates the return/risk ratio, conceived by the late Harry Markovitz who passed away a few days ago, the investment has been left to mature without any reduction in exposure over time.

As can be easily seen, the return with 10% of digital assets in the portfolio would have doubled (in the period 2015 to date) with an increase in volatility just over 20%.

One thing is clearly understood from this graph, and I am speaking to those who have money in current accounts and do not want to invest it: if you really want to leave your money in liquidity, know that, paradoxically, if you invested 10% in a fund that invests in digital assets (or in digital assets directly but with many more risks), you could get a return higher than a 100% investment in the stock market, for example the MSCI World index, but with a decidedly lower risk, obviously with a time horizon adequate.

But I am convinced that the clients of financial advisors do not keep money in current accounts, with the rising inflation we have today, and therefore figure 2 will be very useful for deciding what percentage to dedicate in one's diversification of portfolio.

Good investments to you all

Daniele

Comments